TEXAS, USA — When you think of all your bills, which do you think might be the most common type of debt on credit reports that are flagged as being in collections? Is it rent, mortgage, credit cards, car payments, utilities, or student loans?

It turns out that the Consumer Financial Protection Bureau found last year that “58% of bills that are in collections and on people’s credit records are medical bills.” The CFPB estimated that 43 million Americans have that particular kind of bad debt on their credit reports.

And Texas has one of the biggest percentages of people who have medical debt that has been turned over to a bill collector. By one count, 22.7% of Texans are in that predicament.

Federal consumer watchdog takes on medical debt reporting

Medical debt is different than other kinds of debt. Medical bills are usually forced on someone; the unplanned debt is accrued because they experience an illness or injury. That is different from credit someone chooses, like a car loan. And unlike a home loan, many times you don’t know upfront how much health care is going to cost.

If you have ever had to decipher a hospital invoice, you know that billing errors can be hard to detect and correct. They can make your medical debt look worse than it really is.

Because of all these things the CFPB announced on March 1, 2022, that it was pulling out the microscope to take a close look at the big three credit reporting agencies (Experian, TransUnion, and Equifax) and hold them accountable for verifying that any bad medical debt that might be hurting your credit is accurate. The CFPB also questioned whether unpaid medical bills should be included on credit reports at all.

After watchdog announcement, credit bureaus announce sweeping changes

Just 17 days after that, the major credit bureaus announced big changes that they say will wipe away about 70% of the medical debt currently weighing down credit reports.

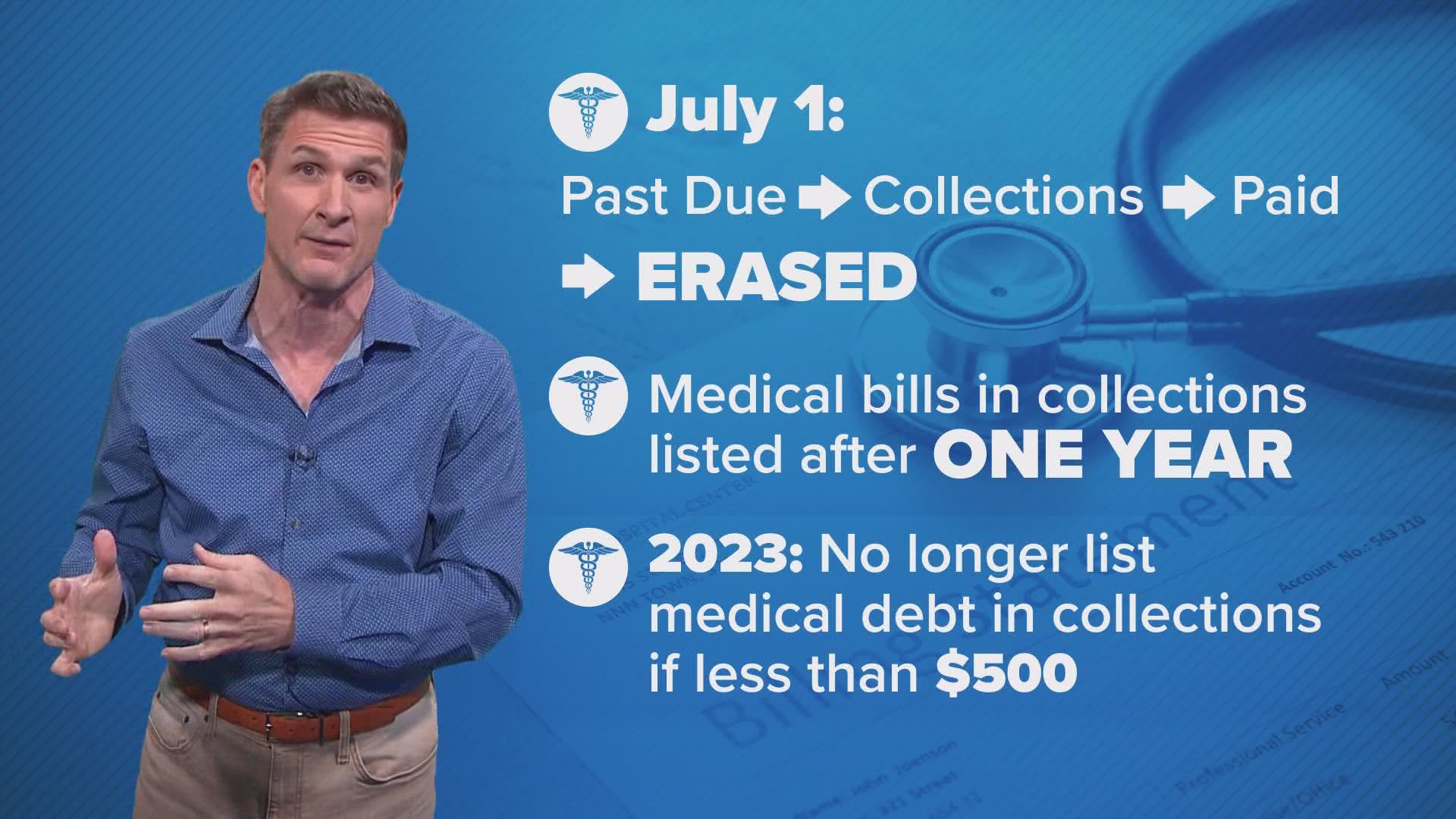

If you had past-due medical bills that went to collections, then you paid them, but that negative info is still on your credit report, those entries will be erased starting July 1.

Also, right now, unpaid health care bills that go to collections can be listed on your credit report after six months. Starting in July, you’ll have a grace period of a year before it shows up on your credit.

And starting next year, the credit agencies will no longer list medical debt that’s in collections if it’s less than $500. This will likely help some credit scores look a lot healthier.

Check your credit reports! They are still free to get.

And a pandemic bonus: Your access to free weekly credit reports has been extended through the end of the year.

Click here to get your reports. And then click the button that says "Request your free credit reports." That will empower you to keep businesses and credit reporting agencies honest. Consumer Reports investigated last year, and 34% of volunteers who checked their creditworthiness found errors on their reports.

If that happens to you, make it known (preferably in writing) to the business that is posting erroneously negative info about you. Also, alert each of the three big credit reporting agencies listing the error.

The credit bureaus have 30 days to investigate and they have to respond to you in writing. And in the case of a mistake that is corrected, if you request it, the credit bureaus must notify anyone who has recently gotten your credit report that it contained an error.

These things make a difference. Especially with interest rates rising, you don’t want to pay even more just because your credit report wrongly makes you look like a bad credit risk.

More useful resources

Forbes published an article that contains a lot of advice about medical debt and credit reports.

Also, the federal government has a page full of rich information about disputing credit report mistakes, as well as specific contact information for each of the three big credit reporting bureaus. They even have a sample letter for you to fill out to dispute credit report mistakes.