LITTLE ROCK, Ark. — It happened so fast.

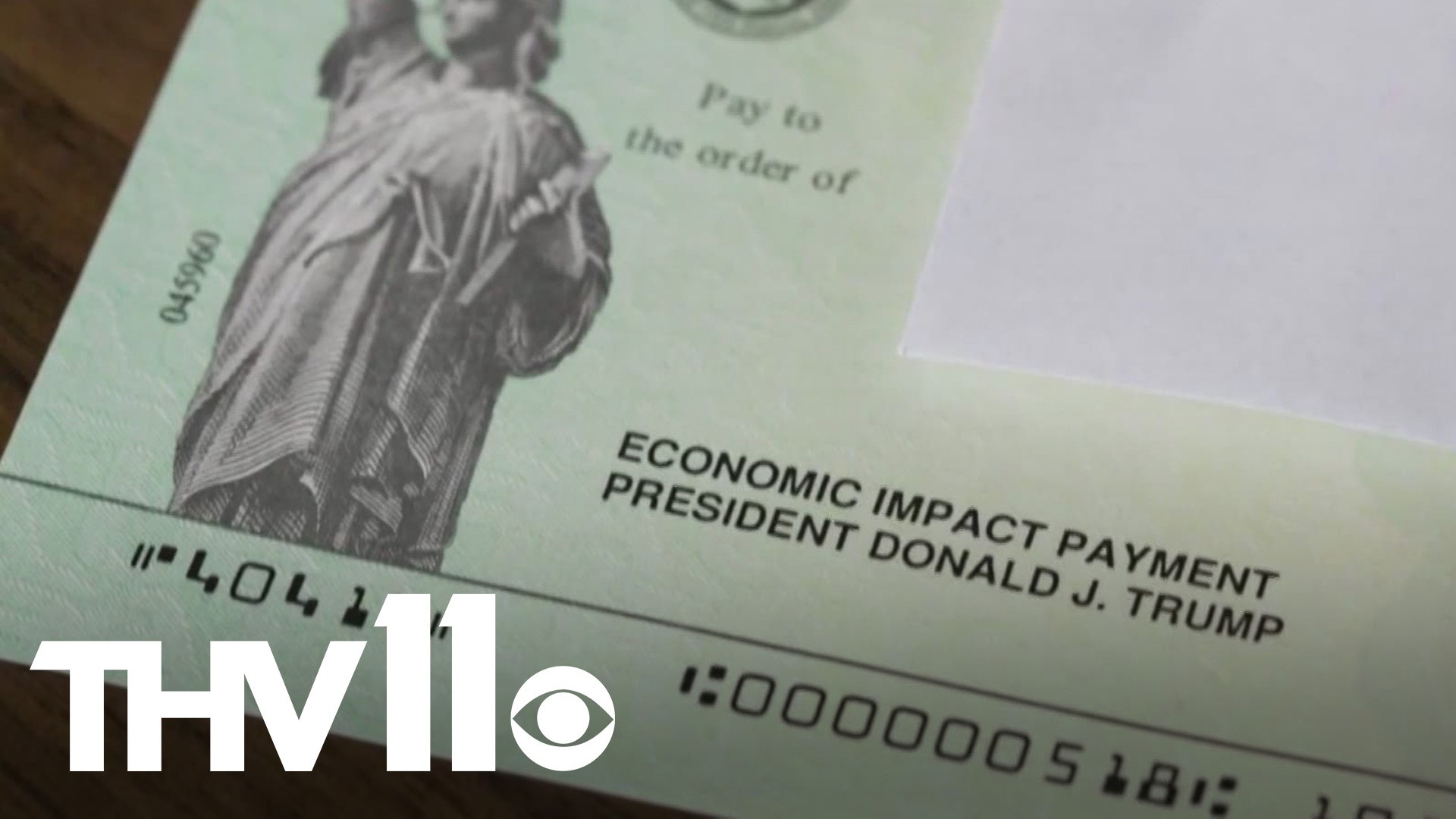

A whole lot of arguing in Congress over how much money to send America in the latest round of pandemic assistance put the IRS in a bind.

When the dust settled a lot of people went through all of January wondering "where's my money?"

"I've had a lot of calls with people saying, 'I didn't get my stimulus payment and what do I need to do?'" said Kim Labbate, a tax counselor and instructor for the AARP's tax assistance teams.

In the rush to get stimulus money out there, the IRS had to rely on the best database they have: all the tax files we send them every year. That left a lot of people out because they don't have to or don't want to file. Not to mention last year was kind of a mess.

"A lot of people did not file their taxes from 2019 because we got shut down early," Labbate said, especially seniors who look to groups like the AARP for help with things like this.

But no matter your age, at this point if you haven't received your money, it's time to move on, because the IRS passed their own deadline on Jan. 19th.

Now, you're going to have to do your taxes to get the stimulus.

"At this point, if they have not received their checks or they received the wrong amount, they're going to have to file a 2020 tax return and file for the recovery rebate credit," said Labbate.

The paperwork won't be difficult. A new line is on all the major IRS forms like the 1040 and the 1040-S. Labbate says you might have to fill in a worksheet to do a quick calculation.

There is one obvious drawback for some people by doing it this way.

"They will use that credit against your 2020 taxes," she said.

Meaning if you owe more than the amount of the stimulus check, the tax agency will use it to pay that off. That's a bummer if you had your eyes on a new flatscreen, but at least the IRS will be off your back.

Plus, Congress seems poised to send still more money your way. Letting the IRS know how to find you will come in handy.

"I think you should file your tax returns for 2020, whether you have to file normally or not," Labbate said. "Just so that you've got some information in there with the IRS so they have something to base their payments on."

Sparing you another delay, because who knows how many more times the IRS and the government will be trying to say "here's your money."