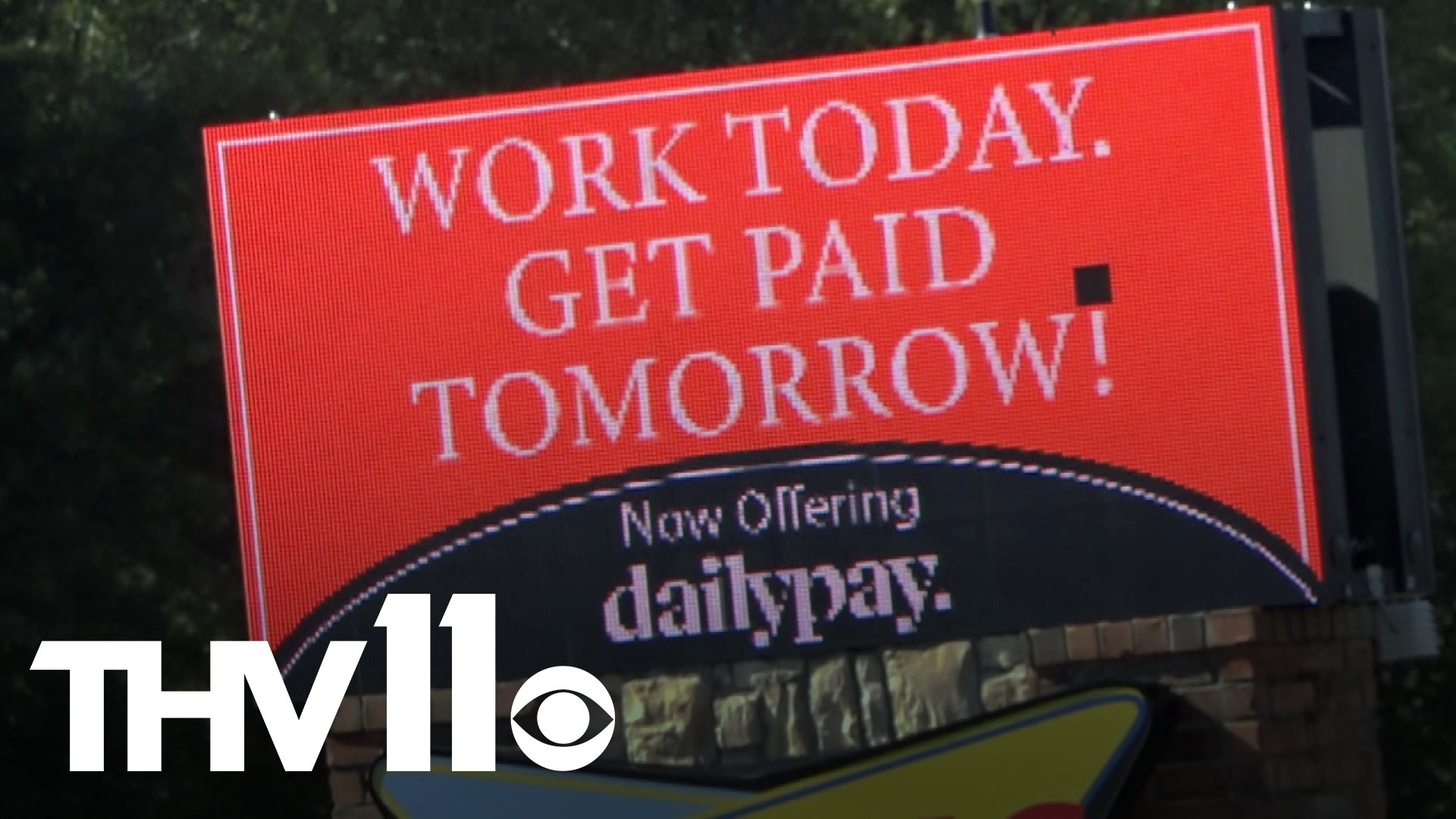

LITTLE ROCK, Ark. — The rotating electronic billboards on two of the busiest Sonic Drive-In locations in Little Rock spend more time trying to attract workers than they do selling shakes and slushes.

Among the panels that flash to drivers on both Broadway and Chenal Parkway is a sign saying "Work today, get paid tomorrow. Now offering DailyPay."

The sign is part of a sequence announcing "Help Wanted" and "Open Interviews" and speaks to the struggle for businesses to jump back into the workforce.

DailyPay is a paycheck-advance app that has gained traction in the last few years.

The concept of making payday any time you want seems overdue in today's fast-paced world, but the concept is just now starting to take off, especially for people with lower wages, a group that is often targeted by predatory lenders.

That association is something that makes executives with the 5-year-old app bristle.

"That's an evil question," said Jeanniey Walden, the chief marketing and innovation officer when asked what makes DailyPay different from a payday loan.

"We are not a payday loan company because there's nothing to repay with DailyPay. As you work, you earn money. As you earn money, that money is yours. We enable people to see how much money they're earning as they work and access that money as they earn it instead of waiting for a traditional company scheduled payday."

Walden explained that the company partners with companies to allow workers to withdraw wages hours after their shifts and before payday by plugging into the firm's payroll manager.

The website or app makes it easy to put money right in a bank account or pre-paid card or other ways to pay bills.

The convenience comes at a cost, with a few dollars for each transaction. For an instant transfer, it'll cost someone $2.99 while a next-day transfer will either cost $1.99 or free.

There is no interest, which is important since exorbitant rates on short-term loans are what led Arkansas lawmakers to outlaw payday loan storefronts about a decade ago.

DailyPay equates the transaction costs with ATM fees.

Among the major employers offering DailyPay are Kroger, Dollar Tree, and Target.

The company brags that seven of the top 10 fast-food chains are signed up including McDonald's and Burger King (though none of those franchises in central Arkansas do so).

That similar trend among companies that rely on low-wage earners raises concerns for some.

"I think that DailyPay can work both ways," said Arlo Washington, president of People Trust Community Loan Fund. "It can be good for some and bad for others. If you don't have good money-management skills, then it could put you into a debt trap."

As a banker working in a space where few big banks choose to do business, Washington said his concerns are less about the red flags that come with payday loans and check-cashing. He worries about financial discipline.

"They're very few low- and moderate-income families that have access to financial education," he said.

DailyPay, for its part, bills itself as a service that can help people facing tougher financial situations by making it possible to avoid costly overdraft and late fees.

"Imagine if you didn't have those anymore, because you could take the money that you needed when you needed it," Walden said.

Washington is inclined to agree with that sentiment as he applauds something the app and others like it do provide, which is better access to money.

"I think for somebody that's not [financially literate] it is a bad deal, but if you have financial education and you can manage the app, I think it's a good thing," he said.

Walden also seeks to allay fears about the transaction fees by saying many of the partner companies pay them on behalf of their employees, and she also said the fees go down or go away the longer the money sits without being claimed.

"We would love it if everybody could get their money without having to have any expense at all," Walden said. "I think that there's an opportunity for us to all figure out."

Arkansas Attorney General Leslie Rutledge’s office told us so far they’ve received no complaints about DailyPay or the way it works.

A spokesperson said the office is following how it evolves but that it appears to be fully compliant with Arkansas law.