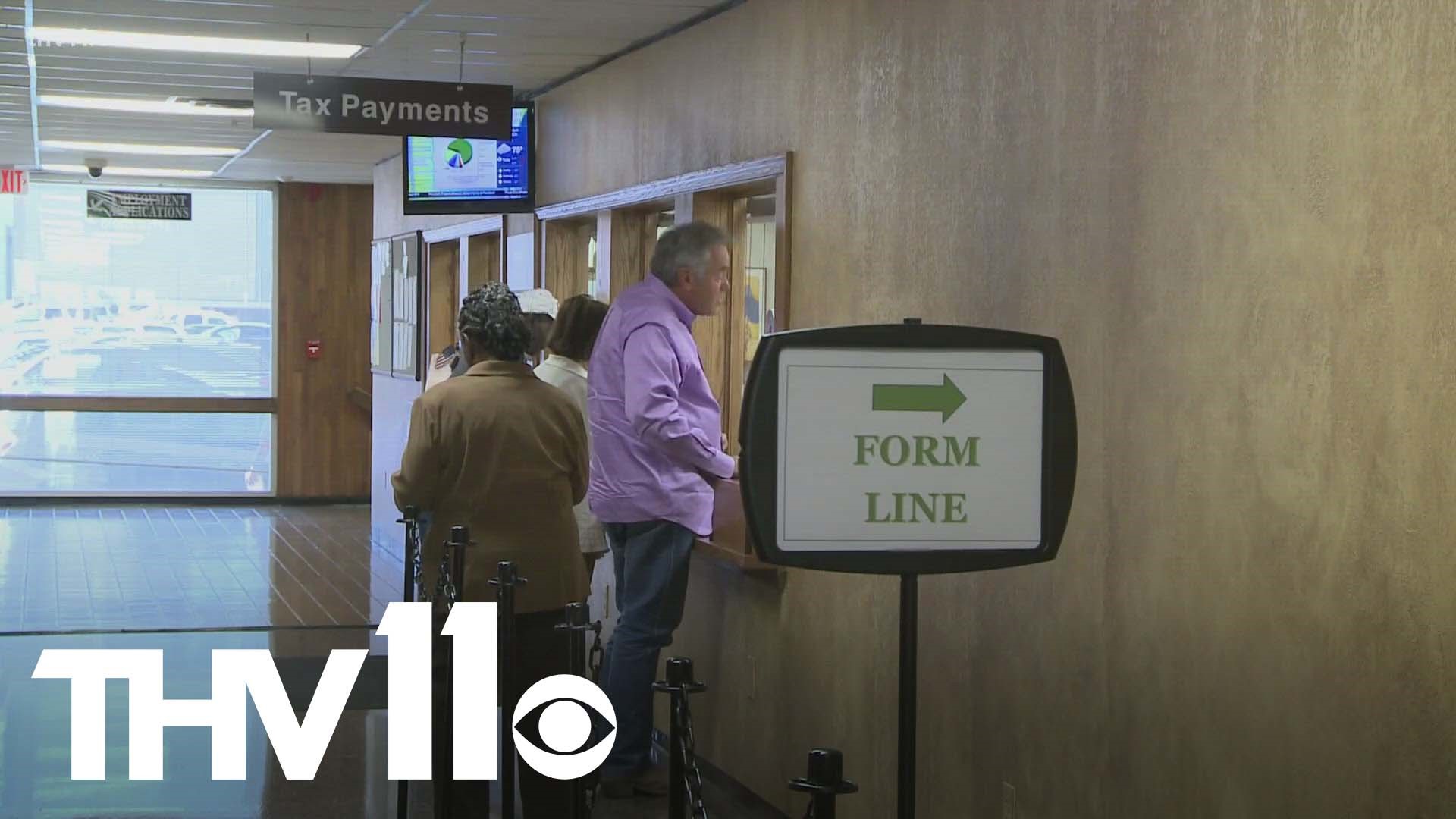

LITTLE ROCK, Ark. — The clock is ticking for you to take care of a state requirement that often slips the mind of many.

We are less than a month away from the deadline to assess your personal property.

State Law requires that you assess every year before May 31 or you will receive a 10 percent penalty.

Pulaski County Assessor’s Office Chief Administrator, Joe Thompson says assessing defined means to value. But to break it down, the assessment procedure is part of the property tax procedure, and you pay property taxes, on your personal property like vehicles and real estate.

Thompson says although the fee can be small for some, they want to help you avoid that penalty.

He says one question they often get is what is the process and deadline if you purchased a car this month.

"If you buy a vehicle in May, you have 30 days from the date of purchase to access. So obviously, if you bought a vehicle on May 20, you wouldn't be expected to assess it by May 31, you have until June 20," Thompson said.

He says another misconception is that although you are assessing for the current year right now, you will actually pay taxes on your property from the previous year.

Thompson says the accessors office will start soon putting out more announcements and reminders through the media to make sure you stay on top of it.

Many counties including Pulaski County have an option for you to stop by the office, simply call in and assess or you can also just go online.