WASHINGTON — There is a lot of information getting thrown at you about the 2020 presidential election. Don’t worry, that's why you have the Verify team to find out what is true and what is false.

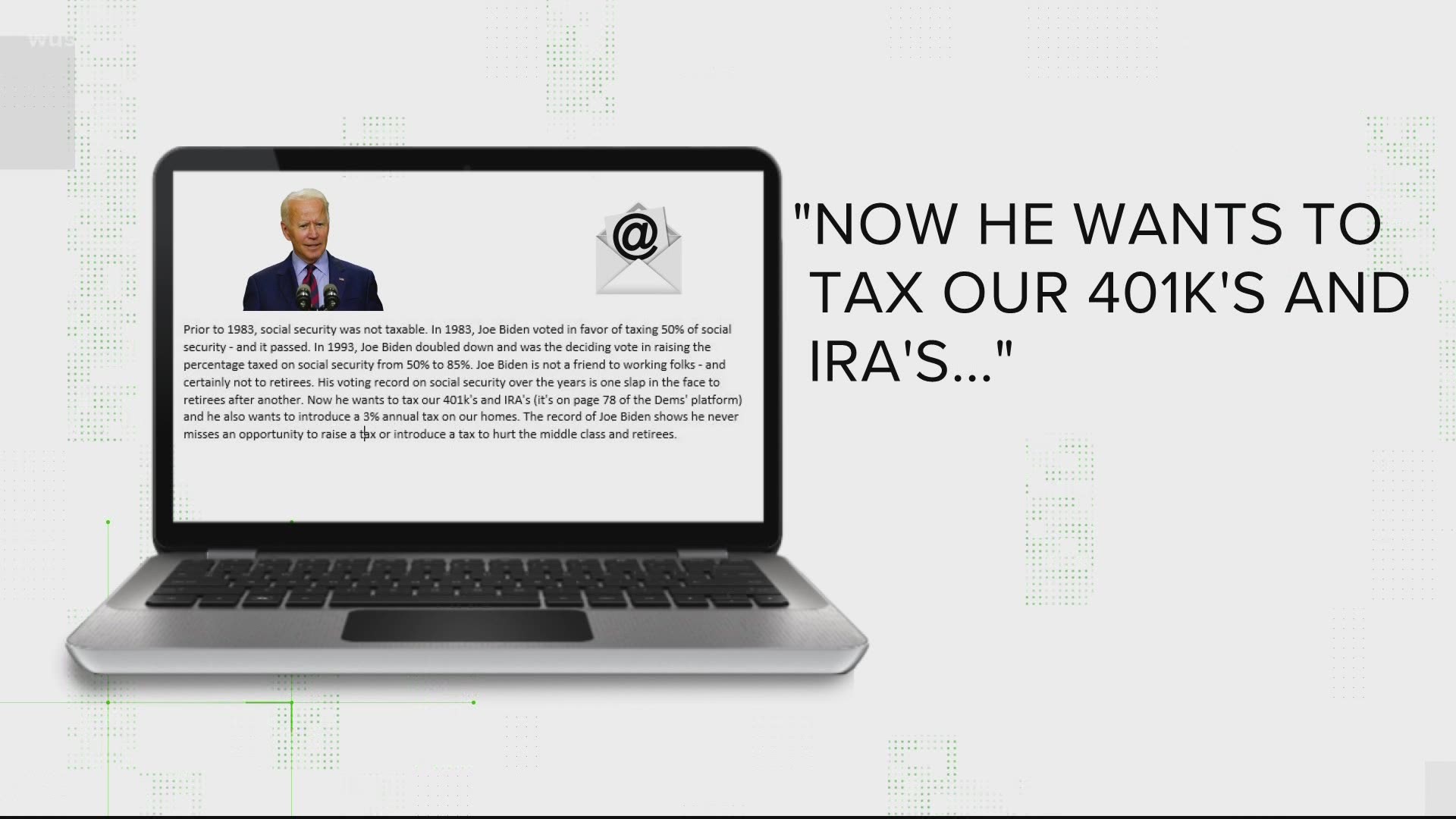

We got a claim sent to our Verify email about Joe Biden’s plan to tax retirement plans.

Question:

Does Joe Biden have a plan to tax your 401ks and IRAs?

Answer:

No, Joe Biden doesn’t plan to tax 401ks and IRAs. They already are taxed. But he does plan to raise the retirement taxes on people making $400,000 or more.

Our Sources:

Two tax "think tanks," the Tax Policy Center and The Tax Foundation. We also used the Biden-Harris Campaign website.

Our researchers went to the Biden-Harris website and found a section about retirement plans.

“The Biden plan will equalize benefits across the income scale so that low and middle-income workers will also get a tax break when they put money away for retirement.

“That’s a very vague statement on his website,” Eric Toder of the Tax Policy Center said. “He is revising the taxation of 401ks.”

From what Toder explained, 401ks and IRAs are already taxed. The Biden plan tries to equalize what all earners can save for retirement.

“It is raising taxes on high-income people who save through IRAs and 401ks. Lowering taxes on lower and middle-income people,” Toder said.

As far as where the Biden camp draws the line of high earners, we asked Garrett Watson of the Tax Foundation.

“Folks earning under $400,000 wouldn’t see any reduced benefit, relative to their current situation,” Watson said. “They really just want to target reducing benefits for those above $400,000.”