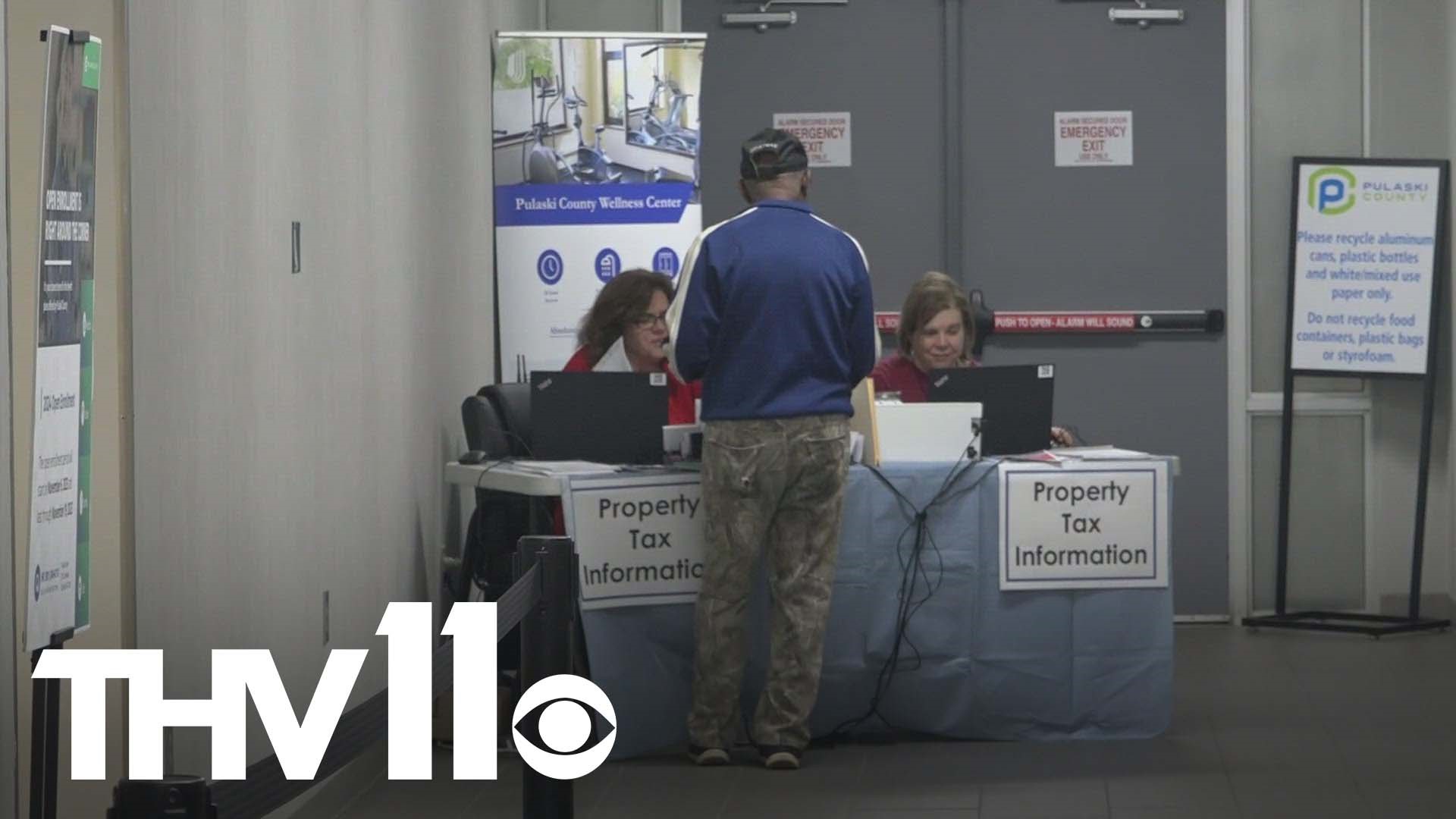

LITTLE ROCK, Ark. — It's Tax Day in the Natural State, and Arkansans have until the end of the day on Monday, October 16 to pay off any property taxes in order to avoid a penalty.

"This year [on the] 17th, there's no option once it's delinquent. I'm not allowed by law to take any kind of payment plan. And the law got changed a few years ago, which we helped with to give people like pay every week every month, social security as it comes, whatever," explained Debra Buckner, Pulaski County Treasurer and Tax Collector.

If your personal property tax goes delinquent, you'll have to pay a hefty late penalty fee which can vary based on the amount you owe.

"But they've got from February until October. So that is sort of the option for the payment plans. Once it's delinquent, we don't have a choice," she added.

However, Buckner said they're trying to make it easy for you to pay in Pulaski County. To find out if you owe in your county, you can click here to visit the state's property tax center.

On the county's website, you can pay via Venmo, PayPal, Google Pay, and Apple Pay. You can also pay in person at any of the four designated Centennial Bank locations listed below:

- 2922 S. University Ave. in Little Rock

- 13910 Cantrell Rd. in Little Rock

- 4514 Camp Robinson Rd. in North Little Rock

- 1816 W. Main St. in Jacksonville

Payments cannot be made inside lobbies. You can live chat, call, or stop by the office on 2nd and Broadway in Little Rock. Click here to learn about more payment options.

A new program called 'GIVE 5' has also been put into place that allows citizens to voluntarily donate $5 dollars to the county's spay and neuter program.

“In Pulaski County, we are breaking all records, we're already 44 million dollars ahead of last year. And this is the first year ever that we will have collected over half a billion dollars," Buckner described.

Overall, she said that the county is in a good spot.

"Who's going to be happy? The schools and libraries, and the hospital, and the Forestry Commission. We're not overstaffed. This is a lot of work. But this is our time to take care of the people that get the checks," Buckner said.

Additionally, Buckner projected that by the time they finish collecting, the county will collect around 95% of property taxes.